Financial Highlights

- Financial Review FY2024

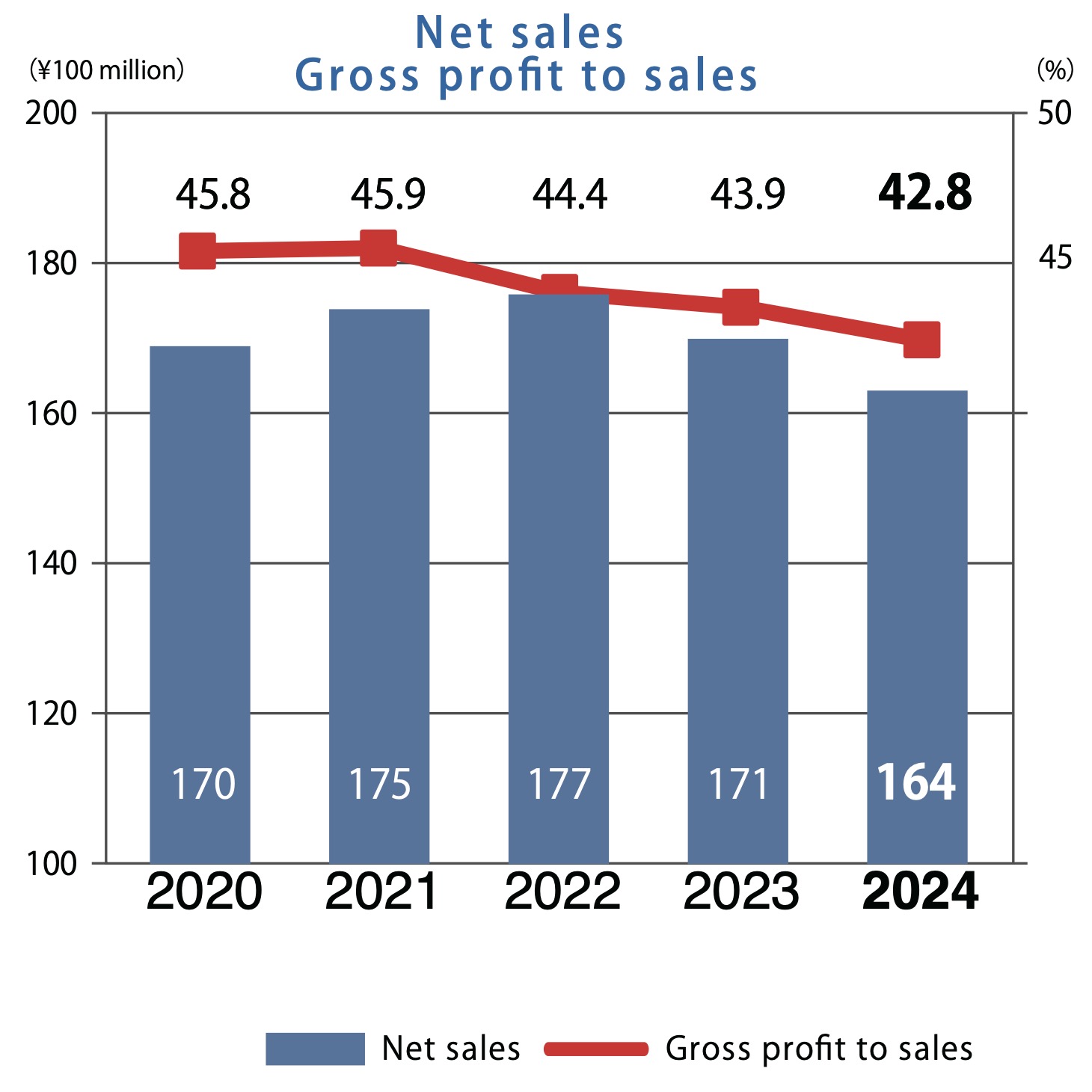

In addition to the impact of inflation from the previous fiscal year, the market has remained in a very challenging business environment due to the abolition of COVID-19 subsidies and a decline in the number of patients. Although both medical and long-term care service fees saw positive revisions, much of the increase was allocated to labor costs, resulting in minimal actual positive contribution.

Our company’s sales in the first half decreased by 6.8%, while the second half saw a smaller decline of 2.5%, but a full recovery was not achieved. The core market saw a 6.4% reduction in revenue. Price negotiations for renewal projects in the low-price market took time, causing a large number of deals to be postponed to the next fiscal year. On the other hand, the peripheral market saw a recovery trend in patient wear during the second half, resulting in a performance almost on par with the previous year for the full fiscal year. Meanwhile, although the overseas market remains small in terms of sales scale, it grew steadily with a 12.5% increase.

| % Change | ||

|---|---|---|

| Net sales | ¥16,412 million | -4.5 % |

| Gross profit to sales | 42.8 % | -1.1 point |

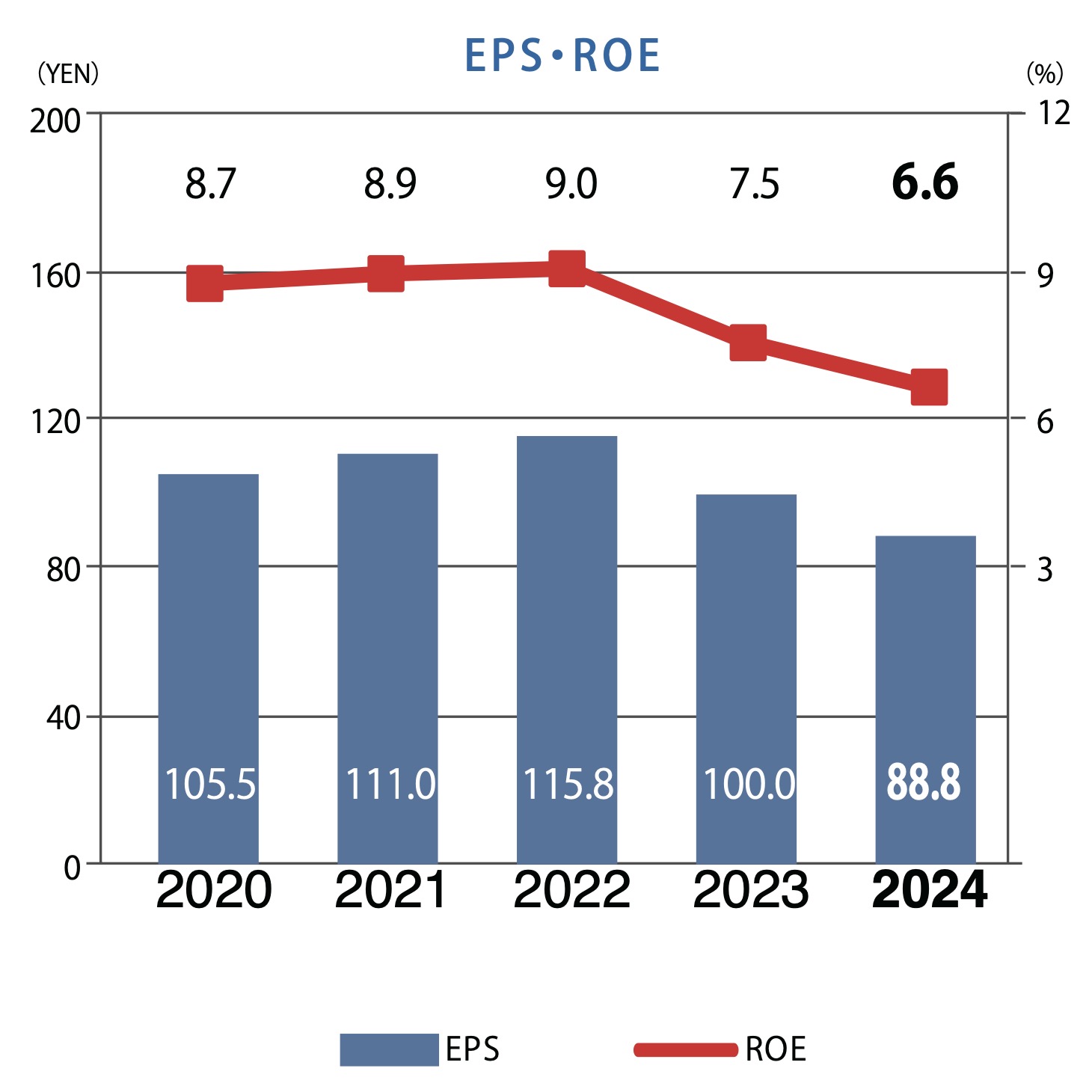

| Operating income | ¥4,004 million | -13.0 % |

| Net income | ¥2,822 million | -12.5 % |

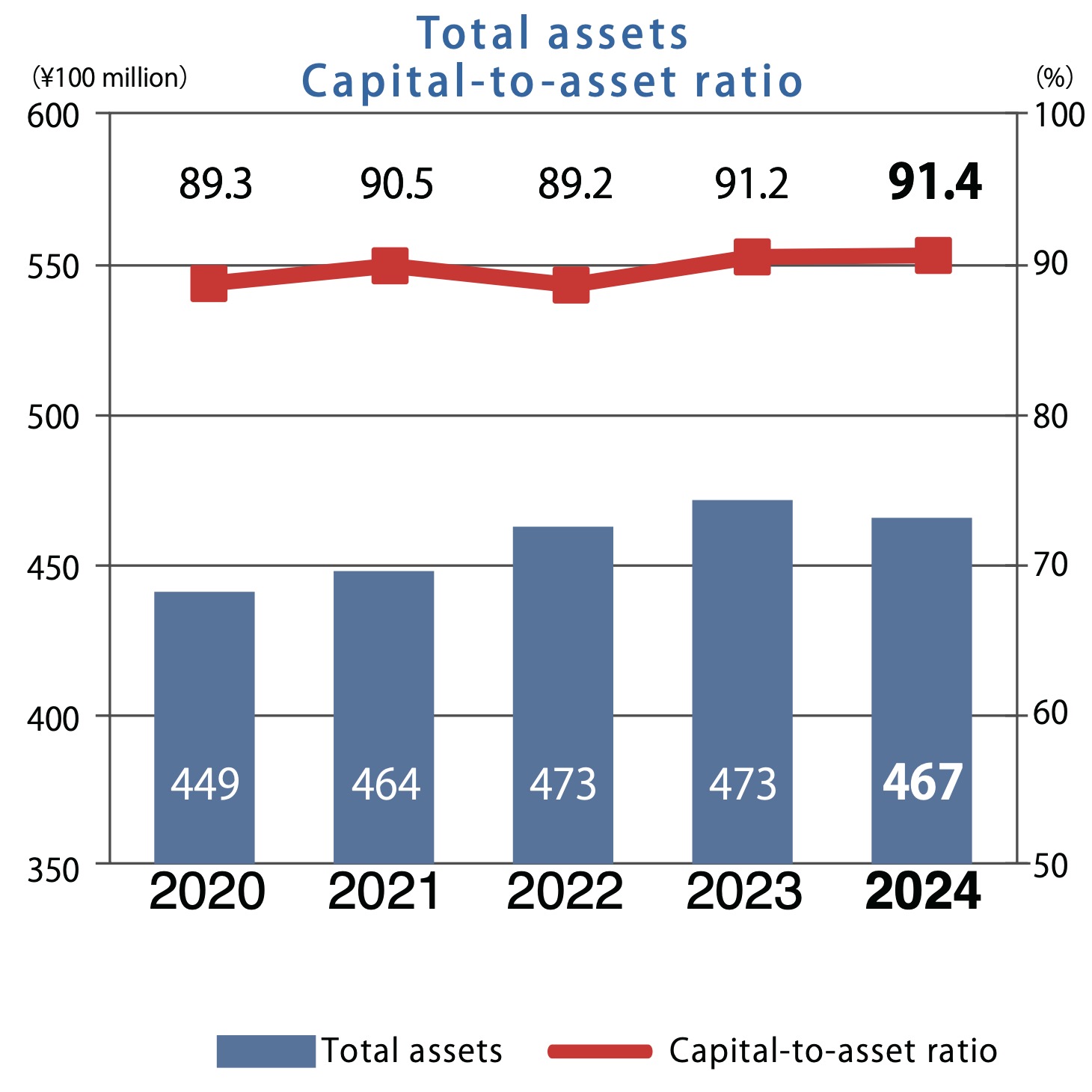

| Total assets | ¥46,727 million | -1.4 % |

| Capital-to-asset ratio | 91.4% |